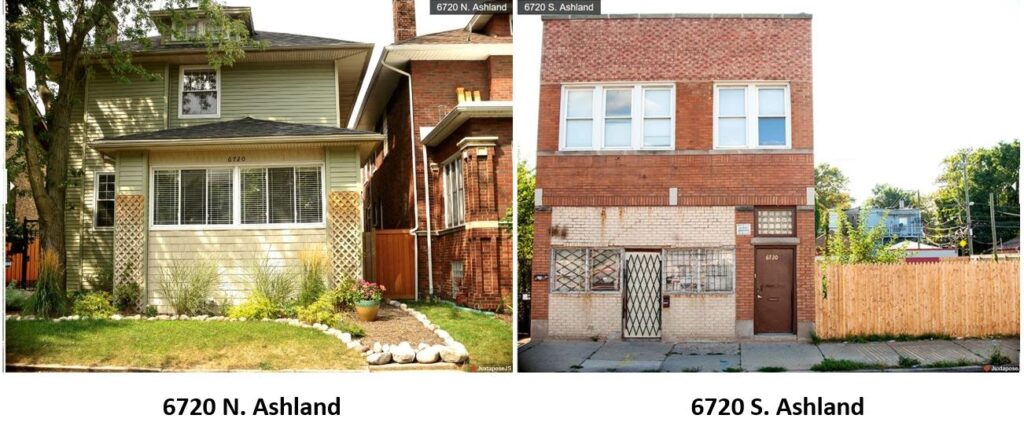

Photo Caption: If you don’t believe in systemic oppression, these photos will show you what it looks like when neighborhoods are left without support. Photo Source: Tonika Johnson and the Folded Map

What is redlining? Redlining is the unlawful practice of denying services based on community demographics, such as race or ethnicity. An example of this includes when banks or financial institutions refuse to provide financial products and services to customers from certain neighborhoods or income statuses.

While redlining is a term that’s come to light more recently, it’s an oppression that’s been unjustly sustained for decades. Neighborhoods thrive when banks and local governments invest in them, yet not all neighborhoods receive this support. Barriers like racial and socioeconomic segregation stop investments from coming in. This treatment is illegal and leads to certain neighborhoods receiving disparate levels of financial support.

[Read Related: Why is my Curriculum so White: Where is the BAME Representation?]

Redlining has been occurring for quite some time but Fair Lending laws and regulations have been put in place for decades to prevent unlawful discrimination when it comes to banks and non-banks. The following cases highlight recent redlining actions taken by the Consumer Financial Protection Bureau (CFPB), Department of Justice (DOJ), and other regulatory bodies working hard to investigate cases and take swift remediation action against organizations that commit redlining.

1) Redlining: CFPB and DOJ action requires BancorpSouth Bank to pay millions to harmed consumers

“The complaint alleges that BancorpSouth illegally denied fair access to credit for residents in minority neighborhoods in the Memphis area by, among other things, opening branches and targeting its marketing activity outside of minority neighborhoods. These actions discouraged prospective borrowers in minority communities from applying for credit. Maps reflecting how BancorpSouth avoided and discouraged prospective borrowers in minority neighborhoods show the alleged discrimination.”

2) Consumer Financial Protection Bureau Files Suit Against Mortgage Creditor for Discriminatory Mortgage-Lending Practices

“As alleged in the complaint, from 2014 through 2017, Townstone drew almost no applications for properties in African-American neighborhoods located in the Chicago-Naperville-Elgin Metropolitan Statistical Area (Chicago MSA) and few applications from African Americans throughout the Chicago MSA.”

3) CFPB and DOJ Order Hudson City Savings Bank to Pay $27 Million to Increase Mortgage Credit Access in Communities Illegally Redlined

“We allege that Hudson City’s redlining practices illegally cut off opportunities for consumers in predominantly Black and Hispanic neighborhoods to get a mortgage and achieve the dream of homeownership,” said CFPB Director Richard Cordray. ‘Without access to affordable credit, neighborhoods deteriorate in the long shadow cast by unfair lending. Today’s action seeks to remove the redline by bringing more than $27 million in mortgage subsidies and outreach programs, along with new bank branches to the communities who should have had access from the beginning.'”

It’s shocking to see how redlining can occur, but sadly, it takes time to prove redlining. Financial consequences build-up for years, across a large number of impacted customers, before redlining can be definitively confirmed by the regulators. Visuals also show the impact of redlining in these areas. Tonika Johnson, a remarkable social advocate in Chicago, and has conducted research that provides photographic evidence of how racially restricted policies have brought about disparities between different neighborhoods. Tonika showcased this by matching up “address pairs.”

[Read Related: Fair Lending: Know Your Rights and Protections as a Consumer]

Let’s say you live at 1200 NORTH Ashland. NORTH Ashland is a nice redeveloped area because banks and local governments invest in the area. Your “address pair” lives at 1200 SOUTH Ashland. Over the years, banks and local governments have provided fewer investments to people living on SOUTH Ashland. As North Ashland gets more and more development money pumped into it, South Ashland remains untouched due to illegal discriminatory practices by banks and local governments. The ramifications of this treatment can last for generations. Tonika provides photo evidence of this and her research on her site Folded Map Project.

There are things we can do as advocates against oppression. You have all the tools you need to fight against redlining and systemic oppression. If you know of any unfair treatment by banks or local governments, it’s important to speak out. Your actions are all the more meaningful as any complaints you file requires a response from the financial institution in question. Historically, consumer complaints are what led to investigations and enforcement actions by government bodies. The nonprofit I cofounded, Building a Financial Future (BaFF), lays out ways to file complaints while also publishing the incredible results that have come from people banding together and exposing injustices.

I find that I have a lot to learn, and I hope we all can help each other by sharing our knowledge. Systemic racism is right outside your door and we all have an obligation to fight to end the cycle. In the words of Desmond Tutu,

If you are neutral in situations of injustice, you have chosen the side of the oppressor.

Together, we can do better!